UAE CORPORATE TAX Impact of Corporate Tax on Individuals & Property Owners in UAE

REAL ESTATE INVESTMENT INCOME FOR NATURAL PERSON

Cabinet Decision No. (49) of 2023

Real Estate Investment – Any investment activity conducted by a natural person related to, directly or indirectly, the sale, leasing, sub-leasing, and renting of land or real estate property in the State that is not conducted, or does not require to be conducted through a License from a Licensing Authority.

Businesses or Business Activities, conducted by a resident or non-resident natural person, shall be subject to Corporate Tax only where the total Turnover derived from such Businesses or Business Activities exceeds AED 1,000,000/- within a Gregorian calendar year.

Activities that give rise to Turnover from the following sources shall not be considered as Businesses or Business Activities conducted by a resident or non-resident natural person subject to Corporate Tax, regardless of the amount of Turnover derived from such activities:

- Wage

- Personal Investment income

- Real Estate Investment income

The natural person that is not conducting a Business or Business Activities subject to Corporate Tax shall not be required to register for Corporate Tax.

CONCLUSION

A Natural Person conducting Real Estate Investment i.e. selling, leasing, sub-leasing and renting of land or real estate property shall not be considered as conducting Business or Business Activity & will therefore, not required to register for Corporate Tax.

REAL ESTATE INVESTMENT INCOME FOR A JURIDICAL PERSON

For the application of the CT Law to companies and other juridical persons, all activities conducted and assets used/held will be considered activities conducted, and assets used/held, for the purposes of a ‘business’. All activities undertaken by a juridical person will be deemed as ‘business activities’ and within the scope of UAE CT, unless specifically exempted.

There is no apparent exemption proposed under the CT decree law for companies earning income from property. It has been mentioned in the FAQs that businesses engaged in real estate management, construction, development, agency and brokerage activities will be subject

to UAE CT.

CONCLUSION

Accordingly, the income/gains from real estate held by companies shall be taxed

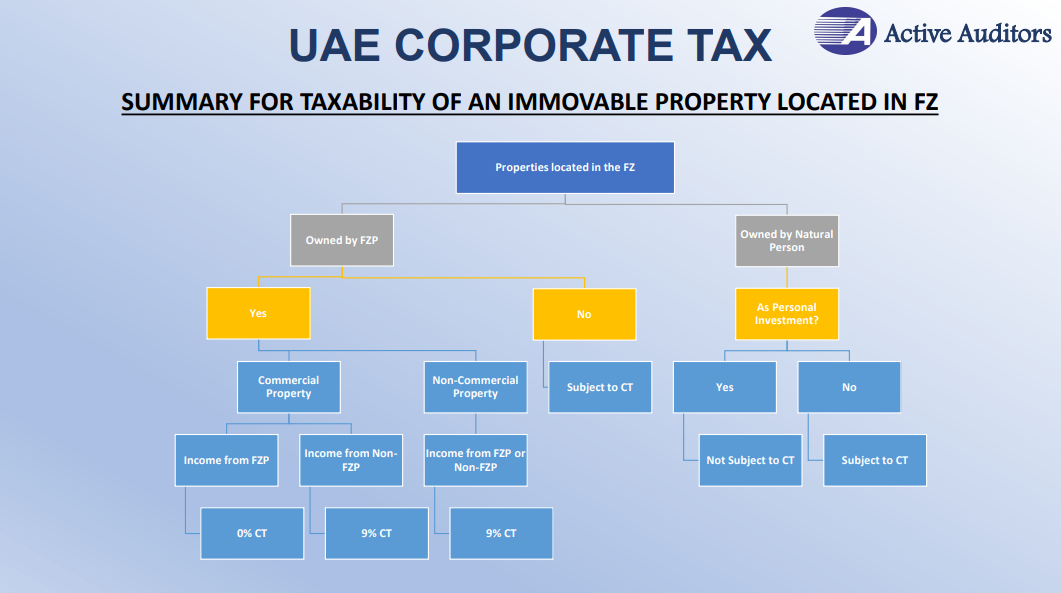

IMMOVABLE PROPERTY LOCATED IN FREE ZONE

Income attributable to immovable property located in a Free Zone that is derived from the below transactions shall be considered Taxable Income and taxed at 9% –

- Transactions with Non-Free Zone Persons in respect of Commercial Property.

- Transactions with any Person in respect of immovable property that is not Commercial Property.

What is Commercial Property?

Immovable property or part there of:

- used exclusively for a Business or Business Activity.

- not used as a place of residence or accommodation including hotels, motels, bed and breakfast establishments, serviced apartments and the like.

PERSONAL INCOME FOR NATURAL PERSON

Businesses or Business Activities, conducted by a resident or non-resident natural person, shall be subject to Corporate Tax only where the total Turnover derived from such Businesses or Business Activities exceeds AED 1,000,000/- within a Gregorian calendar year.

Activities that give rise to Turnover from the following sources shall not be considered as Businesses or Business Activities conducted by a resident or non-resident natural person subject to Corporate Tax, regardless of the amount of Turnover derived from such activities:

- Wage

- Personal Investment income

- Real Estate Investment income