UAE CORPORATE TAX

INTRODUCTION

As announced on 31st January 2022, the United Arab Emirates (UAE) will introduce a Federal Corporate Tax (CT) on business profits that will be effective for financial years starting on or after 1 June 2023.

Thereafter, on 9th December 2022, UAE Corporate Tax has been released vide Federal Decree Law Number No. 47 of 2022, hereafter known as the CT Law.

Recently, this Decree Law is further supplemented by Ministerial decisions on specific matters concerning this law.

CORPORATE TAX RATES

Individuals & Juridical Person

- 0% on the portion of the Taxable Income not exceeding AED 375,000/-

- 9% on Taxable Income that exceeds AED 375,000/-

Qualifying Free Zone Persons

- 0% on Qualifying Income.

- 9% on Taxable Income that is not Qualifying Income.

SCOPE & APPLICABILITY

Corporate Tax shall be imposed on a Taxable Person. A Taxable Person shall be either a Resident Person or a Non Resident Person.-

RESIDENT

- A legal person incorporated in UAE, including a Free Zone Person;

- A foreign legal person managed & controlled in UAE

- Natural persons (Resident or Non-Resident individuals) who conduct a Business or Business Activity in the UAE & total turnover exceeds AED 1 million. Excluding Wages, Personal Investment Income & Real Estate Investment Income.

NON RESIDENT

- Has a Permanent Establishment in the State.

- Derives State Sourced Income.

- Has a nexus in the State

EXEMPTED PERSONS

- Government Entities

- Government Controlled Entities

- Person Engaged in Extractive Business

- Person Engaged in Non Extractive Natural Resource Business

- Qualifying Public Benefit Entity

- Qualifying Investment Fund

- Public/private Pension or Social Security Fund

- Juridical Person incorporated in the State that is wholly owned & controlled by an exempt person in (a), (b), f) & (g), if specific conditions are satisfied

- Any other Person as may be determined in a decision issued by the Cabinet at the suggestion of the Minister.

EXCEPTION FROM REGISTRATION

The following Persons shall not register for Corporate Tax with the Authority:

- A Government Entity.

- A Government Controlled Entity.

- A Government Controlled Entity.

- A Person engaged in a Non-Extractive Natural Resource Business.

- A Non-Resident Person that derives only State Sourced Income and that does not have a Permanent Establishment in the State according to the provisions of the Corporate Tax Law.

QUALIFYING FREE ZONE PERSON

A Qualifying Free Zone Person is a Free Zone Person that meets all of the following conditions:

- Maintains adequate substance in UAE

- Derives Qualifying Income

- Has not elected to be subject to CT

- Complies with Arm’s length Principle & Transfer pricing documentation

- Its non-qualifying revenue does not exceed the de minimis requirements [lower of AED 5M or 5% of the total revenue]

- It prepares Audited financial statements

If a Qualifying Free Zone Person fails to meet any of the conditions, or makes an election to be subject to the regular Corporate Tax regime, they will be subject to the standard rates of Corporate Tax from the beginning of the Tax Period where they failed to meet the conditions and it will not be considered as a QFZP for that year and the subsequent 4 years .

Qualifying Income

Qualifying Income of the Qualifying FZP shall include the below, provided that shall include the below categories of income, provided that such income is not attributable to-

- Domestic Permanent Establishment or

- Foreign Permanent Establishment

- Income derived from

transactions with other Free Zone Persons, except for income derived from Excluded Activities.

– Income will be considered as derived from transactions with a Free Zone Person where that Free Zone Person is the Beneficial Recipient of the relevant services or Goods. - Income derived from

transactions with a Non-Free

Zone Person, but only in respect

of Qualifying Activities that are

not Excluded Activities. - Any other income provided that the Qualifying Free Zone Person satisfies the de minimis requirements

- Manufacturing of goods or materials.

- Holding of shares and other securities.

- Ownership, management and operation of Ships.

- Reinsurance services that are subject to the regulatory oversight of the competent authority in the State.

- Fund management services that are subject to the regulatory oversight of the competent authority in the State.

- Wealth and investment management services that are subject to the regulatory oversight of the competent authority in the State.

- Headquarter services to Related Parties.

- Treasury and financing services to Related Parties.

- Financing and leasing of Aircraft, including engines and rotable components.

- Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale.

- Logistics services.

- Any activities that are ancillary to the activities

listed in paragraphs (a) to (l).

Excluded Activities

- Any transactions with natural persons, except transactions in relation to the Qualifying Activities specified under paragraphs (d), (f), (g) and (j) of Clause (1) of Article (2) of this Decision.

- Banking activities that are subject to the regulatory oversight of the competent authority in the State.

- Insurance activities that are subject to the regulatory oversight of the competent authority in the State, other than the activity specified under paragraph (e) of Clause (1) of Article (2) of this Decision.

- Finance and leasing activities that are subject to the regulatory oversight of the competent authority in the State, other than those specified under paragraphs (i) and (j) of Clause (1) of Article (2) of this Decision.

- Ownership or exploitation of immovable property, other than Commercial Property located in a Free Zone where the transaction in respect of such Commercial Property is conducted with other Free Zone Persons.

- Any activities that are ancillary to the activities listed in paragraphs (a) to (f) of this Clause.

De Minis Requirements

- the de minimis requirements shall be considered satisfied where the non-qualifying Revenue derived by the Qualifying Free Zone Person in a Tax Period does not exceed 5% (five percent) of the total Revenue of the Qualifying Free Zone Person in that Tax Period or AED 5,000,000 , whichever is lower.

- Non-qualifying Revenue is Revenue derived in a Tax Period from any of the following:

- Excluded Activities.

- Activities that are not Qualifying Activities where the other party to the transaction is a Non-Free Zone Person.

- The following Revenue shall not be included in the calculation of non-qualifying Revenue and total Revenue:

- Revenue attributable to immovable property located in a Free Zone derived from the following transactions:

- Transactions with Non-Free Zone Persons in respect of Commercial Property.

- Transactions with any Person in respect of immovable property that is not Commercial Property.

- Revenue attributable to a Domestic Permanent Establishment or a Foreign Permanent Establishment of the Qualifying Free Zone Person.

Income Attributable to a Domestic Permanent Establishment or a Foreign Permanent Establishment of QFP-

- Shall be considered Taxable Income and taxed @ 9%.

- The Taxable Income of any such establishment for that period is calculated as if the establishment was a separate and independent Person that is a Related Party of the QFP.

Income Attributable to Immovable Property Located in a Free Zone-

- Income attributable to immovable property located in a Free Zone that is derived from the below transactions shall be considered Taxable Income and taxed @ 9%.-

- Transactions with Non-FZP in respect of Commercial Property.

- Transactions with any Person in respect of immovable property that is not Commercial Property.

- The Taxable Income for a Tax Period shall be the income that is attributable to the immovable property referred to above calculated in accordance with the relevant provisions of the CT Law.

Maintaining Adequate Substance in a Free Zone and Outsourcing

- A Qualifying Free Zone Person shall undertake its core income-generating activities in a Free Zone and, having regard to the level of the activities carried out, have adequate assets, an adequate number of qualified employees, and incur an adequate amount of operating expenditures.

- Activities can be outsourced to a Related Party in a Free Zone or a third party in a Free Zone, provided the Qualifying Free Zone Person has adequate supervision of the outsourced activity.

SMALL BUSINESS RELIEF

The Ministerial Decision on Small Business Relief stipulates the following:

- Taxable persons that are resident persons can claim Small Business Relief where their revenue in the relevant tax period and previous tax periods is below AED 3 million for each tax period. This means that once a taxable person exceeds the AED 3 million revenue threshold in any tax period, then the Small Business Relief will no longer be available.

- The AED3 million revenue threshold will apply to tax periods starting on or after 1 June 2023 and will only continue to apply to subsequent tax periods that end before or on 31 December 2026.

- Revenue can be determined based on the applicable accounting standards accepted in the UAE.

- Small Business Relief will not be available to Qualifying Free Zone Persons or members of Multinational Enterprises Groups (MNE Groups) as defined in Cabinet Decision No. 44 of 2020 on Organising Reports Submitted by Multinational Companies. MNE Groups are groups of companies with operations in more than one country that have consolidated group revenues of more than AED 3.15 billion.

- In tax periods defined in the decision where businesses do not elect to apply for Small Business Relief, they will be able to carry forward any incurred Tax Losses and any disallowed Net Interest Expenditure from such tax periods, for use in future tax periods in which the Small Business Relief is not elected.

- With regard to the artificial separation of business, the Ministerial Decision specifies thatwhere the Federal Tax Authority (FTA) establishes that taxable persons have artificially separated their business or business activity and the total revenue of the entire business or business activity exceeds AED3 million in any tax period and such persons have elected to apply for Small Business Relief, this would be considered an arrangement to obtain a Corporate Tax advantage under Clause (1) of Article 50 regarding the general anti-abuse rules of the Corporate Tax Law.

Categories of Taxable Persons Required to Prepare and Maintain Audited Financial Statements

The following categories of Taxable Persons shall prepare and maintain audited financial statements:

- A Taxable Person deriving Revenue exceeding AED 50,000,000 (fifty million United Arab Emirates dirhams) during the relevant Tax Period.

- A Qualifying Free Zone Person.

EXEMPT INCOME

The Following income and related expenditure shall not be taken into account in determining taxable income:

- Dividends and other profit distributions received from UAE incorporated or resident legal persons – thus domestic dividends are exempt without any conditions.

- Dividends and other profit distributions received from a Participating Interest in a foreign juridical person;

- Income from a foreign branch or permanent establishment where an election is made to claim the “Foreign Permanent Establishment” exemption; and

- Income derived by a Non-Resident Person from operating aircraft or ships in international transportation

that meets the conditions of Article 25 of Decree-Law.

PARTICIPATION EXEMPTION

A Participating Interest means, a 5% (five percent) or greater ownership interest in the shares or capital of a juridical person or where the aggregated acquisition cost of the ownership interests in that juridical person as provided for in Article (2) of this Decision is equal to or exceeds AED 4,000,000.

Dividends and other profit distributions received from a Participating Interest in a foreign juridical person shall be exempt provided that –

- The Taxable Person has held, or has the intention to hold, the Participating Interest for an uninterrupted period of at least (12) twelve months.

- The Participation is subject to Corporate Tax at a rate atleast 9%.

- The Taxable Person is entitled to receive not less than 5% (five percent) of the profits available for distribution and liquidation proceeds.

- Not more than 50% of the participation assets consist of ownership interest or entitlements that would not qualify for exemption under Corporate Tax.

- If it is subject to a tax charged in respect of income, equity or net worth, or a combination of any or all of these in that other country or foreign territory, and the tax levied results in an effective tax rate of not less than (9%) nine percent on the accounting profits of the Participation calculated in accordance with the Accounting Standards in the relevant Tax Period.

Other points to be considered-

- None of the following shall result in the tax imposed under the applicable legislation of the other country or the foreign territory in which the Participation is resident for tax purposes to not be considered a tax that is applied on a similar basis to Corporate Tax :

- Differences in reductions and reliefs.

- Lower tax rates applicable to certain brackets of income.

- Targeted incentives or exemptions of a temporary nature.

- Application of alternative taxes on income or profits.

- A tax imposed under the applicable legislation of the other country or foreign territory in which the Participation is resident for tax purposes shall not be considered a tax which is of a similar nature to Corporate Tax in any of the following cases:

- The tax is applicable only to selected activities.

- The tax paid is refunded at the time of distribution of the relevant profits or income.

- The tax is only due in the event of a distribution of profits or income.

INTEREST DEDUCTION LIMITATION RULE

General Interest Deduction Limitation Rule

- Net Interest expenditure will be deductible upto 30% of the Taxable Person’s accounting earnings before the deduction of interest, tax, depreciation and amortization (EBITDA) for the relevant Tax Period, excluding any Exempt Income.

- The amount of Net Interest Expenditure disallowed may be carried forward and deducted in the subsequent (10) ten Tax Periods.

- The interest capping rules shall not apply to banks, insurance provider & a natural person undertaking a Business or Business Activity in the State.

The limitation on the deductible Net Interest Expenditure shall not apply where the Net Interest Expenditure for

the relevant Tax Period does not exceed AED 12,000,000 (twelve million dirhams).

Specific Interest Deduction Limitation Rule

- No deduction shall be allowed for Interest expenditure incurred on a loan obtained, directly or indirectly, from a Related Party in specific cases.

- Deduction allowed if the main purpose of obtaining loan & carrying out transaction is not to gain CT Advantage.

- No Corporate Tax advantage shall be deemed to arise where the Related Party is subject to Corporate Tax under the applicable legislation of a foreign jurisdiction on the Interest at a rate not less than 9%.

NON Auditors -DEDUCTIBLE EXPENSES

- Donations, grants or gifts made to an entity that is not a Qualifying Public Benefit Entity.

- Fines and penalties, excluding compensation for damages or breach of contract.

- Bribes or other illicit payments

- Withdrawals from business

- Dividends, profit distributions or benefits paid to an owner of the Taxable Person

- VAT Input

- Tax on income imposed on the Taxable Person outside the state

- Entertainment, amusement or recreation expenses for customers, shareholders, suppliers or other business partners – 50% deductible

- Interest expenditure subject to capping

TRANSFER PRICING

RELATED PARTIES

A related party is an individual or entity who has a pre-existing relationship with a business through ownership, control or kinship

ARM’S LENGTH PRINCIPLE

In order for a transaction or arrangement between Related Parties or with a Connected Person to meet the arm’s length standard, the results of the transaction or arrangement must be consistent with what the results would have been if they had been between parties that are not related to each other. Accepted TP Methods- Comparable cost price method, the resale price method, the cost plus method, the transactional net margin method, the transactional profit split method.

PAYMENTS TO CONNECTED PERSON

payments or benefits provided by a business to its “Connected Persons” will be deductible only if the business can demonstrate that the payment or benefit

- corresponds with the market value of the service provided; and

- is incurred wholly and exclusively for the purposes of the taxpayer’s business.

CONDITIONS FOR MAINTAINING MASTER FILE AND LOCAL FILE

A Taxable Person that meets either of the following conditions shall maintain both a master file and a local file in the relevant Tax Period:

- Where the Taxable Person, for any time during the relevant Tax Period, is a Constituent Company of a Multinational Enterprises Group as

defined in the Cabinet Decision No. 44 of 2020 referred to above that has a total consolidated group Revenue of AED 3,150,000,000 or more in the relevant Tax Period. - Where the Taxable Person’s Revenue in the relevant Tax Period is AED 200,000,000 (or more.

TAX GROUPS

- Can be formed between resident legal persons. Parent company should hold at least 95% of the share capital, voting rights & entitled for profits & Net Assets of its subsidiaries.

- Cannot be formed with Exempt Person and Qualifying Free Zone Person.

- All entities must have same financial year end & financial statements must be prepared using accounting standards.

Main consequences-

- Consolidation of Financial results, assets & liabilities of tax group members.

- Elimination of transactions between the Parent company & each subsidiary which is a member of tax group

- Filing of one tax return by the parent company.

- Specific provision for pre-grouping tax losses & losses upon cessation of tax group or once a subsidiary leaves or join the tax group.

TAX LOSS PROVISIONS

Tax loss Relief

- A Tax Loss can be offset against the Taxable Income of subsequent Tax Periods to arrive at the Taxable Income for those subsequent Tax Period. The amount of Net Interest Expenditure disallowed may be carried forward and deducted in the subsequent (10) ten Tax Periods.

- No tax loss relief for losses incurred before-

- before the date of commencement of Corporate Tax

- before a Person becomes a Taxable Person

- from an asset or activity the income of which is exempt, or otherwise not taken into account under this Decree-Law.

- The interest capping rules shall not apply to banks, insurance provider & a natural person undertaking a Business or Business Activity in the State.

Transfer of Tax Loss

- A Tax Loss or a portion thereof may be offset against the Taxable Income of another Taxable Person if all the below conditions are met

- Both are Resident Juridical Person

- None of the Persons are an Exempt Person or Qualifying Free Zone Person

- 75% ownership interest

- The Financial Year of each of the Taxable Persons ends on the same date

- Both Taxable Persons prepare their financial statements using the same accounting standards.

- The total tax Loss offset shall not exceed 75% of the taxable income.

- The Taxable Person shall reduce its available Tax Losses by the amount of the Tax Loss transferred to the other Taxable Person for the relevant Tax Period.

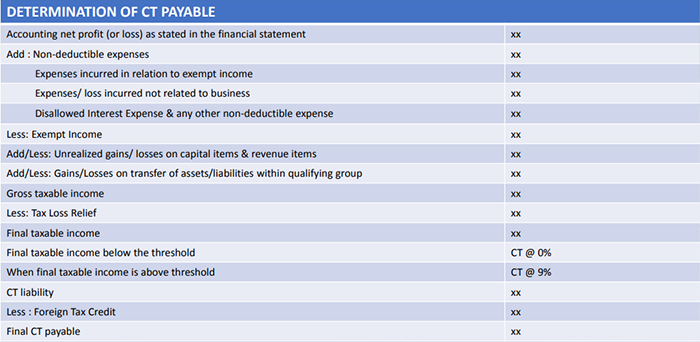

CALCULATION OF CT

ADMINISTRATION

Registration and deregistration

A business subject to CT will need to register with the Authority and obtain a Tax Registration Number within a prescribed period.

A Tax Deregistration application has to be filed with the Authority where there is a cessation of its Business or Business Activity, whether by dissolution, liquidation, or otherwise, in the form and manner and within the timeline prescribed by the Authority.

Filing, payment and refund

Each tax return, payment and related supporting schedules will need to be submitted to the FTA within nine (9) months of the end of the relevant Tax Period.

Financial Statements

The Authority may, by notice or through a decision issued by the Authority, request a Taxable Person to submit the financial statements used to determine the Taxable Income for a Tax Period in the form and manner and within the timeline prescribed by the Authority.

Record Keeping

Taxable Person shall maintain all records and documents for a period of (7) seven years following the end of the Tax Period to which they relate