UAE VAT Law

Registration for VAT

Only VAT registered businesses will need to charge and account for VAT.

Mandatory Registration: A business must register for VAT if the taxable supplies and imports exceed the mandatory registration threshold of AED 375,000.

Voluntary Registration: A business may choose to register for VAT voluntarily where the total value of its taxable supplies and imports (or taxable expenses) is in excess of the voluntary registration threshold of AED 187,500.

Tax Invoice / VAT Invoice

- Must be issued within 14 calendar days from the date of supply.

- In case of Zero Rated Supply, no need to issue a Tax Invoice provided sufficient records are available to establish the particulars of supply.

- No Tax Invoice in case of Exempt Supplies.

- Where an agent makes supply of goods and services on behalf of principal, the agent may issue a Tax Invoice as if they are making the taxable supply, as long as the principal does not issue a Tax Invoice as well.

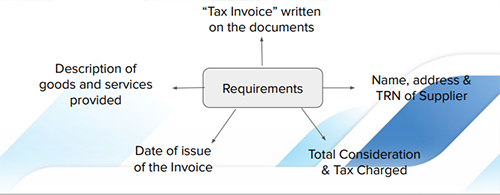

Tax Invoice: Requirements

- “Tax Invoice” must be displayed on the invoice.

- Name, Address and TRN of the supplier as well as the Recipient, if registered.

- Sequential or unique number identifying the document.

- Date of issue of Invoice.

- Date of Supply (if different from the invoice date).

- Description of goods and services provided.

- For each goods and service: Unit Price, quantity supplied, applicable rate of tax, and the amount payable expressed in AED.

- Discount given, if any

- Gross amount payable expressed in AED.

Tax Invoice: Requirements

- If an invoice is issued in any currency other than AED, then amount of tax in AED and exchange rate must be stated.

- If an invoice is related to a Supply where the recipient must account for reverse charge VAT: a statement that the recipient must self account for that tax and a reference to the relevant legislation.

- Supply made in GCC Implementing state:

- TRN that was issued to the recipient, and

- Statement identifying the supply between UAE and the implementing state.

Simplified Tax Invoice

- Fewer administrative requirement.

- It can be issued instead of Standard Tax Invoice if it relates to

- Supply made to a recipient that is not VAT Registered, or

- Supply made to a VAT Recipient person but the consideration for supply is less than AED 10,000

Errors

- VAT has been incorrectly charged where no tax was due, or

- The wrong amount of tax was charged.

Rectification

- In case the Tax shown is higher than it should be- Issue a Tax Credit Note.

- In case the Tax shown is lower than it should be- Issue an Additional Tax Invoice.

Tax Credit Note: Requirements

- “Tax Credit Note” displayed on the credit note

- Name, address & TRN of Supplier

- Name, address & TRN of recipient, if registered

- Description of goods and services provided

- Date of issue of Tax Credit Note

- Value of supply in the original invoice, Correct value of supply, Difference between the two, tax charged in AED that relates to such difference

- A brief explanation of the circumstances giving rise to issuance of tax credit note

- Sufficient information which can be used to identify the supply to which tax credit note relates.

Record keeping requirements

All related documents should be kept for at least 5 years from the end of the tax period to which they relate.

Conditions for Input Tax Recovery

- The recipient must be a taxable person.

- The consideration has been paid or the recipient must have an intention to pay within 6 months of the agreed date of payment.

- If consideration paid in part then input shall be available for the part payment.

- In case the consideration is not paid within 6 months then no input tax shall be available. If the input tax has already been claimed then the same must be repaid.

- The recipient has received and retained a tax invoice for supply.

- Goods and services must have been acquired or used for an eligible purpose.

- VAT must have been correctly charged by the supplier.

- VAT amount must not be specifically blocked from recovery (e.g. client entertainment)

Input Tax Recovery- Eligible purpose

Goods and services on which the VAT was charged must be used, or intended to be used, for making eligible supplies in the course of a business- that is for one or more of the following:

- Taxable Supply in the UAE (subject to the standard or zero-rate of VAT)

- Supplies that are made outside the UAE that would have been taxable if they were made in the UAE.

- Supplies of Financial

Services made outside the UAE that would have been VAT exempt if made in the UAE.

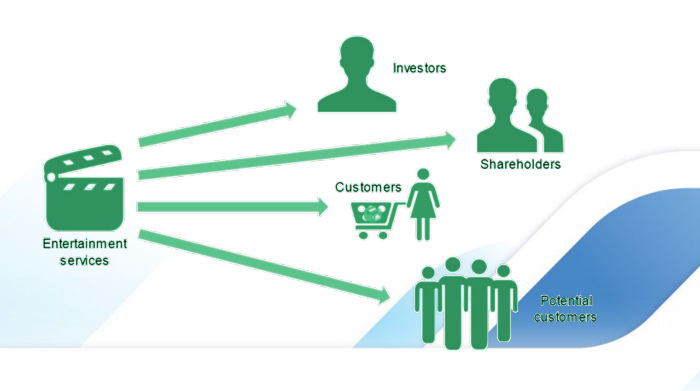

Specific Input Tax Blocks: Client Entertainment

A non- government entity cannot recover VAT that has been incurred on entertainment services to anyone that is a non-employee. This includes customers, potential customers, official shareholders and other owners or investors.

Specific Input Tax Blocks: Employee gifts or services

Input tax that relates to goods or services (including entertainment services) that are purchased to be used by employees for their personal benefit at no charge to them cannot be recovered unless it is:

- A legal obligation for the employer to provide the goods or services;

- A contractual obligation or documented policy for the employer to provide those services in order that they may perform their role; or

- The provision of the goods or services which is a deemed supply for VAT purposes.

Specific Input Tax Blocks: Personal use of Motor Car

Input tax is not recoverable if it is incurred on the purchase, rental or lease of a motor vehicle that is available for personal use by any person.

A motor vehicle is road vehicle that transport no more than 10 people including the driver. It does not include a truck, forklift, hoist or other similar vehicle.

Input tax can be recovered if it is:

- A licensed taxi;

- A motor vehicle registered and used as an emergency vehicle. For example, by police, fire, ambulance or similar emergency service;

- Rented to customers in a vehicle rental business.

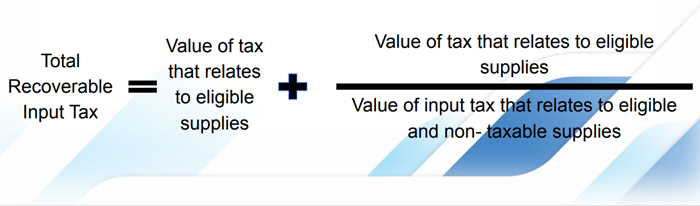

Input Tax Apportionment

VAT incurred on expenses can only be recovered to the extent that it relates to eligible supplies.

Where a business makes both taxable and non- taxable supplies, it has to identify how much of the VAT that it has incurred can be recovered.

Input Tax Apportionment: Annual adjustment

Apportionment calculation is to be carried out for each tax period and also at the end of each tax year.

The purpose is to compare the amount of input tax recovered in each tax period throughout the tax year to the amount that should have been recovered on an annual basis, in order to take account of any season fluctuations in the business and produce a fair and reasonable VAT recovery position.

The adjustment may show input tax has been under-recovered (amount due to be paid by FTA) or over-recovered (amount due will be paid back to FTA).

The adjustment should be made in the first tax period following the end of the tax year.

Filing VAT Returns

VAT return filing along with payment for VAT has to be made within 28 days from the end of the relevant tax period.

VAT Refund

VAT Refund can be claimed in a number of circumstances. Following people can claim for VAT Refunds.

- UAE Nationals: Building New Residences

- Tourists: can claim Tax Refund as well as can opt for Tax Free Shopping.

- Business Visitors:

- No place of establishment or fixed establishment in the UAE or an Implementing State.

- Not a taxable person in the UAE.

- Not carrying on Business in the UAE.

- Carrying on a Business and are registered as an establishment with a competent authority in the jurisdiction in which they are established.

VAT Designated Zone

Certain Free Zones have been specified as designated zones for VAT purposes. While special rules apply to supplies made in the designated zones, the businesses established in such zones may still need to register for VAT provided the criteria for registration is met.

Designated Zones are:

- Subject to strict control criteria.

- Required to have Customs procedures to control the movement of goods into and out of the designated zone.

- Treated as being outside the territory of the UAE for VAT purposes for certain supplies of goods.

- Required to have security procedures in place to control the movement of goods and people to and from the designated zone.

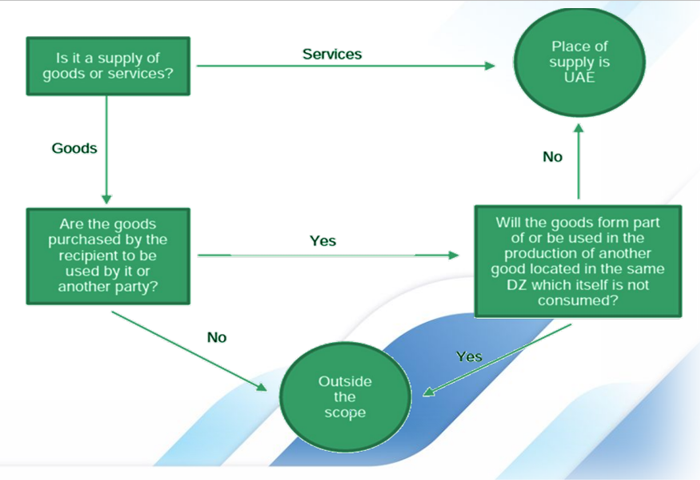

VAT Designated Zone

Decision making process for determining the Actual Place of Supply for goods and services in a designated zone for VAT purpose.

Voluntary Disclosure

A Voluntary Disclosure is a form (VAT Form 211) provided by the FTA that enables the taxpayers to voluntarily notify the FTA about the error or omission in a previous Tax Return, Tax Assessment, or Tax Refund application.

However on using Voluntary Disclosure Form, penalties may be levied by the FTA.

There are two types of Voluntary Disclosure penalties that will be jointly levied, one which is fixed penalty and the other being percentage based depending upon the situations or timing of the disclosure.

VAT Reconsideration

Reconsideration is a request application that can be submitted to the authority if the person is not satisfied with the penalty decision issued by the authority.

It can be submitted by a Registrant/ Non-registrant or tax agent after preparing a proper case study that produces evidence justifying the reason.

The FTA may take 45 business days to respond back on the application from the date it is received.

VAT Deregistration

If a company –

- Cease making taxable supplies; or are still making taxable supplies but the value in the preceding 12 calendar months is less than the Voluntary Registration Threshold then it must apply for de registration within 20 business days from the occurrence of the event.

- Are still making taxable supplies but the value in the previous 12 months was less than the Mandatory Registration Threshold; and 12 months have elapsed since the date of registration in case of registration on a voluntary basis then the company may apply for voluntary de-registration.

Thank You !!

Contact Details:

Tel:- (O) : 06-5552785, 04-2659330

(M) : 050-6248402, 054-5309566

Email : contact@activeauditors.com

Website : www.activeauditors.co